Renting vs Buying – 50 Pros and Cons

There is no universal right or wrong in the rent vs. buy discussion. It comes down to what is right for YOU. Before getting into the list of pros and cons, a couple of things to consider first.

- With homeownership comes responsibility, while renting may be relatively carefree.

- Rent vs. Buy Ratio There is a generally accepted “rent vs. buy rule of 15,” which says multiply the annual rent of a comparable property by 15.

- So if rent is $1,000 a month, that’s $12,000 annually. Multiple that number by 15 and you’ve got a suitable purchase price of $180,000.

- A common formula is a “price-to-rent ratio” that follows the same formula, whereby you take the list price and divide it by one year’s rent.

- Using our prior example, $180,000 divided by $12,000 would be 15. General wisdom considers ratios of 1-15 as more favorable to buy than rent, whereas numbers of 16+ favor renting.

Of course, hot cities like Washington DC, New York City and Los Angeles will typically have much higher ratios along with much higher purchase prices, so look closely at your budget and ratio before jumping to any conclusions. Don’t rely on any blanket rules to make your decision, create a detailed personal budget first to see if there are items that you’re willing to give up in order to comfortably afford to buy a home. Sometimes that hot new pair of boots, or a quick trip to Vegas are going to be more important. You have to be prepared to lose some of that budget freedom before jumping into buying a home.

Pros of Renting

- Typically, the cost of renting is less than the cost of home ownership, especially when considering taxes, insurance, HOA or condo fees and maintenance.

- A mortgage may appear cheaper at first, but what happens when the toilet breaks? You can’t call a landlord, you have to call a plumber and have the cash to pay that plumber.

- There’s also psychological freedom to renting. You most likely have a 12 month lease commitment or maybe you’re month to month. Not so when you own a home. It’s likely you’re looking at 90 days or more before you’re able to make a move.

Cons of Renting

- On the flip side, renting is temporary. Renting is not the best way to establish a household. You can be asked to leave by your landlord when it’s convenient for them. YOU’RE the temporary part of the equation.

- You’re limited to what you can do in the property. No pets allowed? You can’t paint, you can’t customize the place to your wants and needs.

- Rent payments don’t stop. Yes, 30 years is a long time to commit to a mortgage, but your lifetime is probably longer.

- No relief from payment in your retirement. You can eventually pay off a mortgage, you’ll still pay a landlord as long as you’re renting.

- In the end, you have nothing to show for it. Nothing to sell and cash out, nothing to hand off to your kids or heirs.

- Rent will likely rise, OK not likely, your rent will DEFINITELY rise, even if you live in a rent controlled property, the rent must rise with the cost of taxes, insurance, water and utilities. A mortgage is a fixed payment (assuming you have a fixed interest rate) for as long as you own the home.

- You might be paying less than your contemporaries who own homes now, but they’ll still be paying the same amount in 10 years, while your rent will rise.

Pros of Buying

- The most obvious is that you gain equity and ownership in your home. In time, the amount you owe on the property decreases while the value increases. Of course there will be market/value fluctuations, but historically all properties increase in value ahead of inflation.

- House, condo or townhome, in time, you’ll own the property, not just the contents.

- Owning may be cheaper month to month than renting depending on where you’re living, due to low interest rates and low entry costs to homeownership.

- Why pay $2,500 in rent if you can make a $2,200 mortgage payment, especially if you can write off the interest and the taxes?

- Right now, real estate interest and taxes are fully tax deductible. Even if you’re paying $2,600 in mortgage vs. $2,500 in rent, with the deductions, you’re still ahead year over year.You have fewer restrictions in a property you own. No need to ask permission to take that wall down or paint the walls purple. It’s up to you.

- You can make the property worth even more in the future by adding on or making other improvements, while also making it more suitable to your family needs and desires.

Cons of Buying

- There are plenty of cons and disadvantages to owning. First, there’s the down payment and other costs associated with purchasing. You’ll need at least 3% of the purchase price, plus another 2% – 3% for closings costs.

- Don’t forget about a few thousand dollars in reserve for lawn mowers, shower curtains, bath mats and some reserves just in case that toilet decides to fail a month after you move in.You’ll always have to pay taxes and insurance, even after your mortgage is paid off. You may even need to pay HOA or condo fees.

- You’re now responsible for everything. Remember when you could call the landlord or the building handyman to fix a leaky faucet? That’s all you now. You’ll need to acquire a whole new set of skills, or make sure you have the cash on hand to hire someone else.

- Stress – every little thing that’s wrong, or will go wrong, with your property will give you stress every single day.

- No packing up and moving on with ease.

- Unloading a property is time consuming and it costs money. Most people overestimate their net proceeds because they forget about transfer fees, realtor fees and the money it takes to prepare a home for market.

- It’s possible you could LOSE money. If you need to sell and the timing isn’t great, you could end up bringing money to the table, be stuck with a short sale or even go into foreclosure if something happens and you can’t make the payments.

Summary

There are plenty of pros and cons to buying vs. renting and vice versa. There is no right or wrong, just right or wrong for YOU.

With renting, you know what you’re getting into, at least for the term of your lease. You won’t make any money, but you won’t explicitly lose any money either. When you buy a home, there’s a gamble on your future and your area’s economic future. You have to put some money into it up front, and make sure you have a good enough job to keep making the mortgage payments. You also need to have an emergency fund set aside, because things will happen with a house. There’s just no way around it, stuff breaks down.

In an ideal world, making the leap of faith into homeownership will pay off for you in the short and long term.

Rent Advantages

May be cheaper than a mortgage payment

Fewer (if any) maintenance costs

No down payment required (less deposit)

No real estate taxes (renters insurance optional)

Less stress (who cares, it’s not yours!)

Freedom to move or downsize when necessary

No risk of home price depreciation

Some utility bills may be included

“Free” amenities such as pool, gym, security

Money can be used for other, more profitable (or just plain fun!) investments

Can’t be foreclosed on

Rent Disadvantages

Rental payment may exceed monthly cost of a mortgage No ownership or wealth creation

Payments never stop when renting

Rent will rise over time

Must deal with a landlord or management company

No tax benefits

Rules, regulations, and limitations

More temporary, less stability

Always at the mercy of the property owner

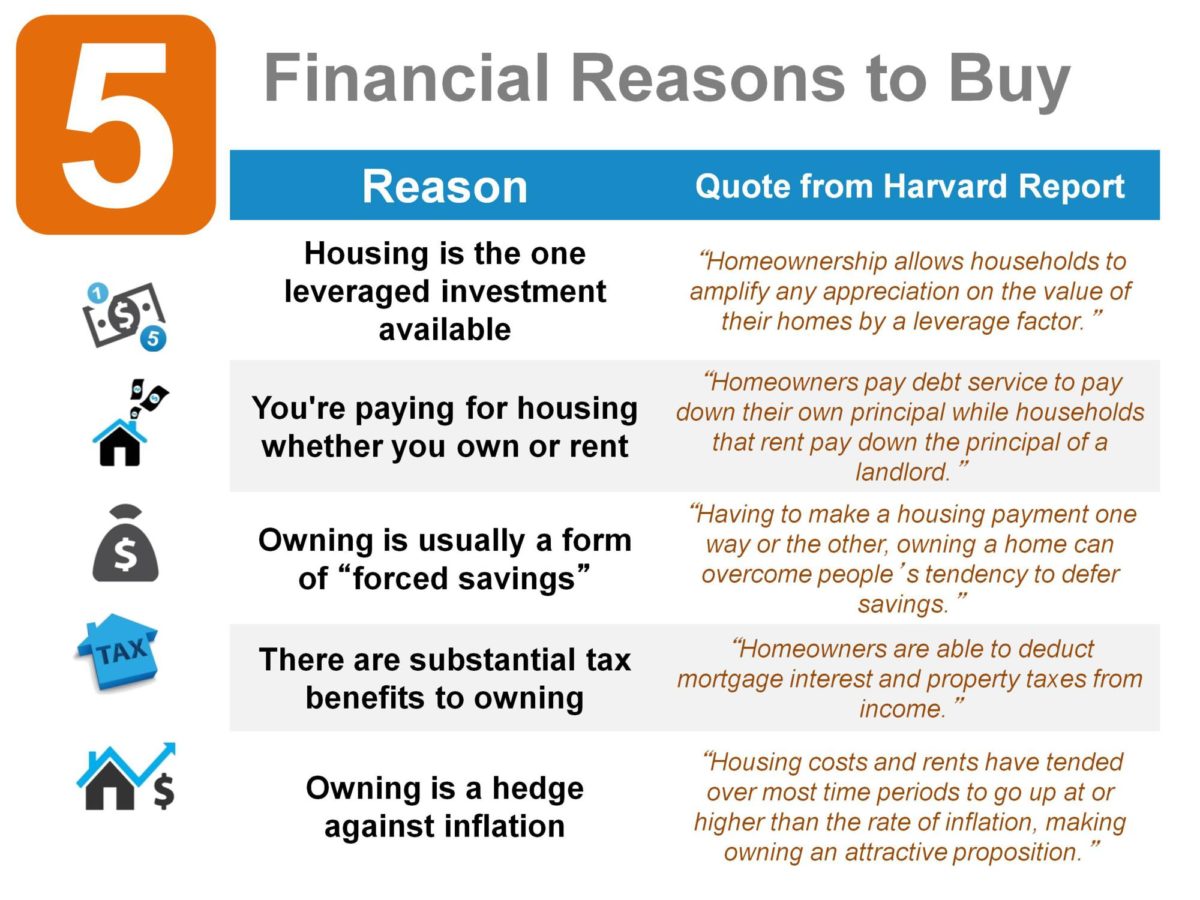

Ownership Advantages

You can build home equity and wealth

Sizable tax deductions possible

Your space, your rules (pets welcome)

Ability to remodel, expand, tear down

Pride of ownership (social status, accomplishment)

Potentially better for children, family structure

Mortgage payments can improve your credit score

Ability to borrow against your home HELOC or CASH OUT

No more monthly payments once mortgage paid off

Fixed payments (if you choose a fixed mortgage)

Mortgages are the cheapest loans available

No landlord

Can exclude capital gains when you sell (partially)

Inflation hedge

Forced savings

Leveraged investment

Can rent out to others

Can sell and use proceeds for bigger/better home

Retirement nest egg

Ownership Disadvantages

Home prices may lose value

Could overpay for your property

Not everyone qualifies for a mortgage

You must pay taxes and homeowners insurance

Total housing payment can be more expensive

Sizable down payment necessary

Maintenance costs can be excessive

Pricey HOA dues (if applicable)

You’re “stuck” in a home (long-term commitment)

Increased liability and responsibility

Transactional costs of buying and selling

Ownership is stressful!

Taxes and insurance generally rise

Your home can be damaged or destroyed (and not fully insured)

Can be foreclosed on and lose your home

Obtaining a mortgage (and finding a home) is a hassle